I. Defining ESG Investing

ESG stands for Environmental, Social, and Governance, which are three key pillars used to evaluate a company’s ethical practices and long-term sustainability. Environmental criteria assess factors such as carbon emissions, resource utilization, and waste management. Social standards include labor practices and workplace diversity. Governance focuses on leadership transparency and board independence.

ESG investing is often associated with values-based decisions and for many investors, aligning their capital with ethical and sustainability principles is a core motivation. However, ESG can also represent a strategic, forward-looking investment approach grounded in economic pragmatism. From this perspective, ESG is about anticipating risks and opportunities in a rapidly changing world. For example, companies that rely heavily on fossil fuels may face declining demand or regulatory risks, while firms investing in clean energy, efficient resource use, and strong governance may be better positioned for long-term growth. Investors may choose ESG either to align with personal values or to invest in anticipated secular trends shaping the global economy—or both.

II. ESG Under Attack in 2025

In 2025, ESG investing is facing sharp backlash. Under President Donald Trump, the federal government has shifted its sentiment regarding ESG priorities, while some major financial institutions have scaled back their ESG investing initiatives.

The Trump administration has cut clean energy subsidies, reduced climate regulations, and reinstated fossil fuel-friendly policies. On July 4th, 2025, President Trump signed the One Big Beautiful Bill Act (OBBBA). The OBBBA includes rollbacks of “clean energy tax credits established or expanded by the Inflation Reduction Act.”(1) On July 7th, 2025, President Trump signed an executive order effectively eliminating federal subsidies for clean energy sources like wind and solar.(2)

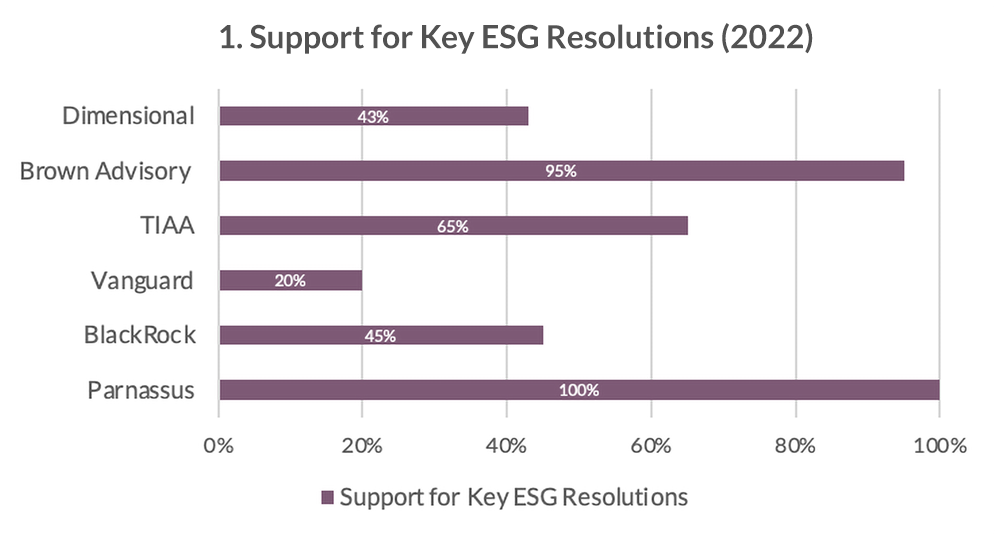

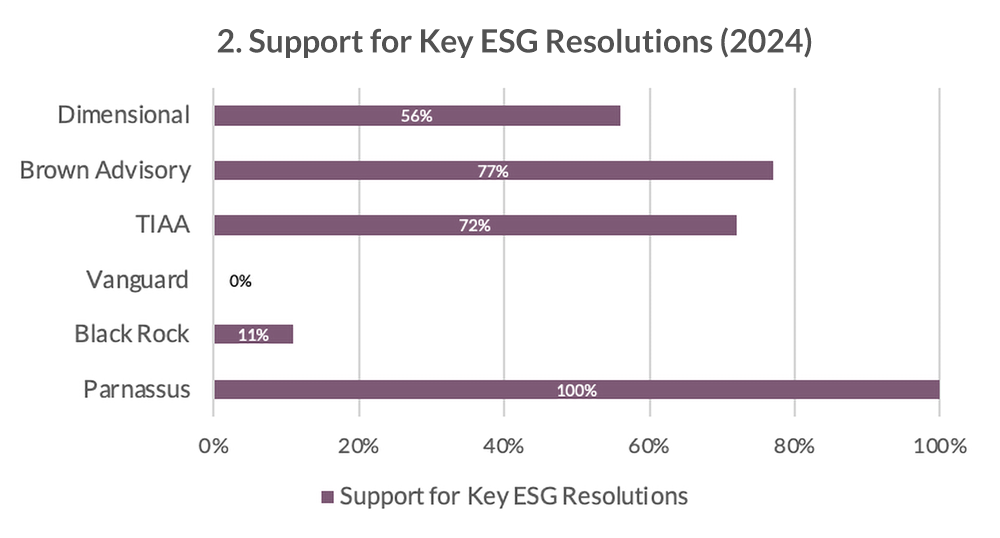

At the same time, prominent investment firms have reduced their support for ESG investments to align with the shifting political climate. In January 2025, BlackRock withdrew from the Net Zero Asset Managers Initiative.(3) The firm also revised its proxy voting policies to no longer include references to gender, race, ethnicity, and age.”(4) Support for ESG resolutions from investment firms has declined, not just at BlackRock, but at several large investment firms (percentages shown below from Morningstar)(5). Notably, Vanguard’s support for key ESG Resolutions fell to 0% in 2024.

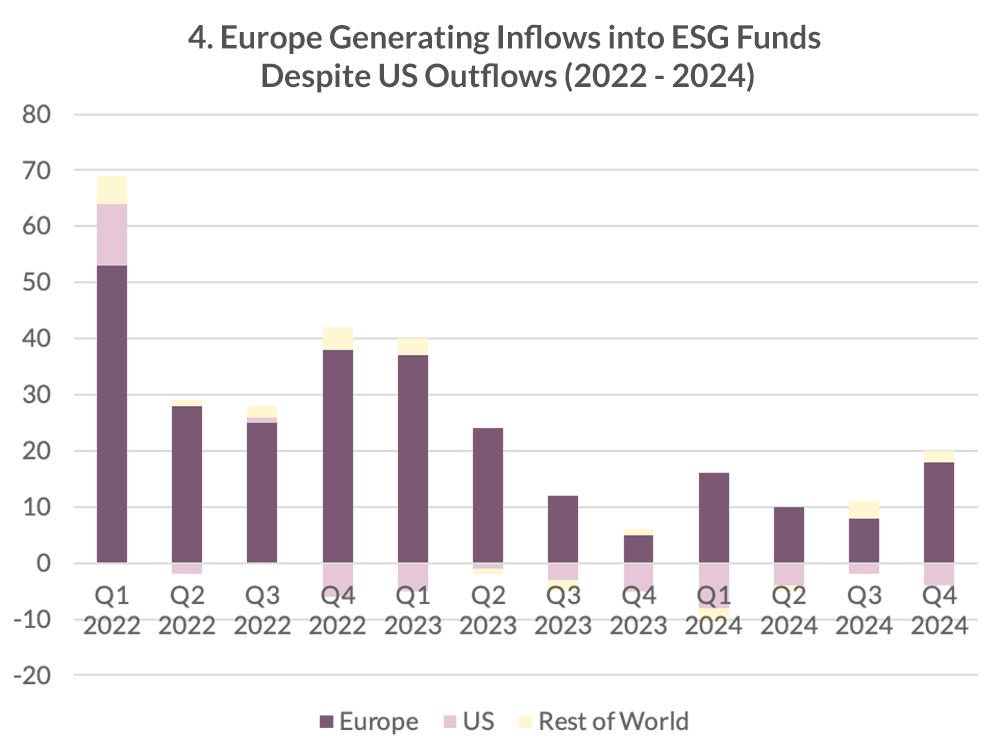

According to Morningstar, ESG funds have suffered several years of outflows in the US, with 2024 marking their worst year.

III. ESG’s Strategic Resilience: Investing in the Future Economy

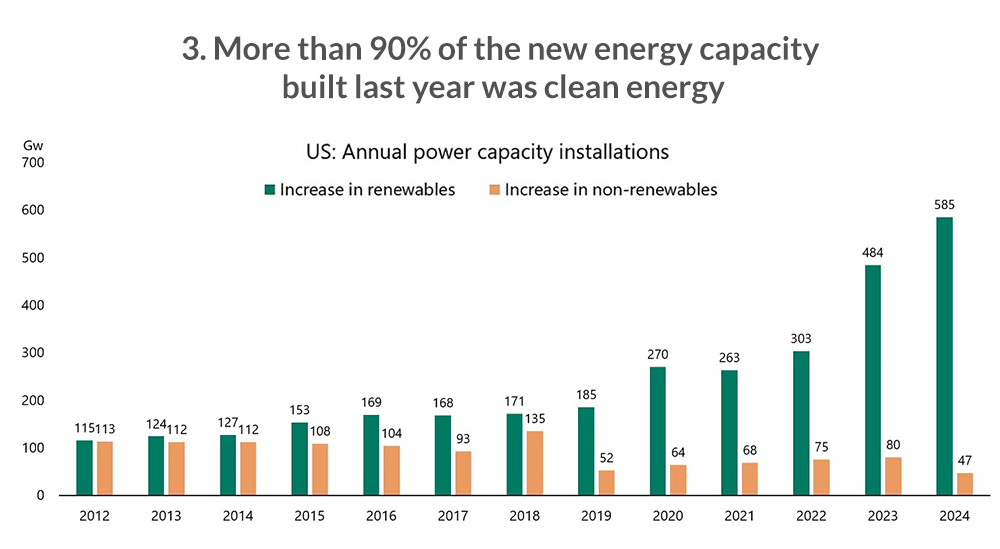

But if ESG is under attack, how do we explain that a stock like Ventas Wind Systems (the largest wind turbine manufacturer in the world) was up over 30% during President Trump’s first six months in office? The fact is, although ESG is under political fire, ESG funds’ performance has held up remarkably well – partly due to real economic shifts favoring sustainable technologies.

According to Leslie Norton at Morningstar, renewable energy stocks are becoming increasingly valuable due to an increase in demand for electricity that is driven by the growing need for energy in AI data centers and the trend of electrification. Research from Lazard found solar and wind energy projects to be more competitive than fossil fuels, even without subsidies. Renewable energy can be brought online faster than many traditional sources, and prices also tend to be more stable than oil markets.

Norton notes that, “According to the Energy Information Administration, after remaining nearly flat for close to 20 years, electricity demand hit record levels in 2024.” She also points out that clean energy is needed to enable the AI economy.(6) Currently, numerous large US companies heavily utilize renewable energy, including Google, General Motors, and HP, to name a few.(7) As AI growth continues to demand more energy, many more companies are likely to join this group.

More positive news for ESG investing is that despite US outflows, there continue to be large net inflows globally over the past few years. European investors, in particular, have generated positive net flows in every recent quarter (see chart).

IV. The Future of ESG

At Plum Street Advisors, we continue to believe that ESG portfolio returns will remain competitive with traditional portfolios in the long run, despite there being periods of over- and under-performance in the short term. Although there have been recent legislative and political pushback on ESG initiatives, numerous positive aspects of ESG investing persist. For example, although BlackRock and Vanguard’s support for key ESG resolutions has diminished, other funds remain highly committed. Total assets remain high, and global ESG funds inflows are strong.

ESG investing may help mitigate risks associated with regulatory changes, environmental degradation, or shifting consumer preferences. By focusing on innovation—such as clean energy, resource efficiency, and responsible governance — ESG investors can gain exposure to companies poised to lead in the evolving global economy.

For diversified ESG portfolios, holding a broad range of sectors, geographies, and stock types, the short-term variations in ESG performance should be disregarded. We see no reason that investments in companies that are judged favorably on ESG criteria won’t do just as well as more traditional companies in the long run. The trick is the same as with any successful portfolio — stay diversified, think long term, and keep costs low.